What is gain or loss on foreign exchange?

Understanding the loss or gain that you may incur as the result of currency exchange fluctuations is crucial to your accounting and decision making

Dealing with foreign currency can be a regular part of your business. Anytime you have a financial transaction with a customer or vendor who uses a different currency, one of you has to deal with the exchange rate. Currency exchange rates are always fluctuating, and as a result, the exact amount you pay or receive might differ from the original invoice amount.

Example scenario

To better illustrate this, let's assume your company uses Euros (€) as the main currency, and you send an invoice to one of your clients in the US. In this case, you decide to issue the invoice in your client's currency (USD) to make payment easier for them.

The invoice is issued on the 1st of March with a nominal value of $10,000.00, which, based on the exchange rate at that time, equals €9,300.00.

For the rest of this article, we will use this scenario to explain gains and losses on foreign exchange.

Recording a loss

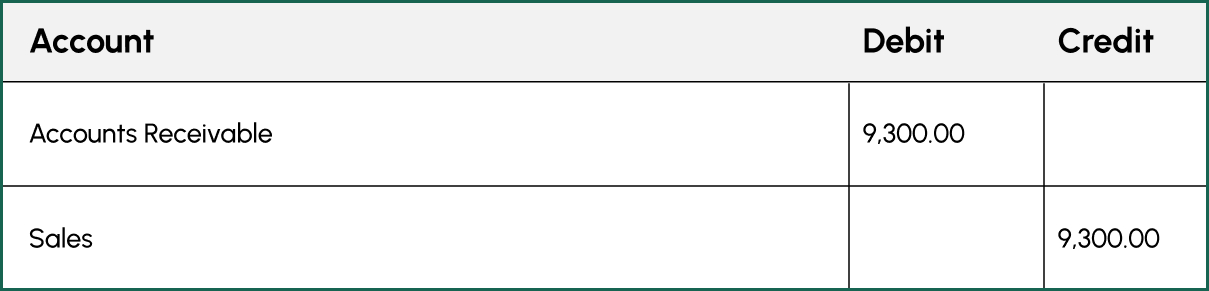

The invoice has a total value of $10,000 and is issued on the 1st of March. Even though the invoice is in USD, we must record the sale in our books using EUR. Based on the exchange rate on March 1st, we record a sale of €9,300.

We credit sales and debit accounts receivable, each for €9,300.

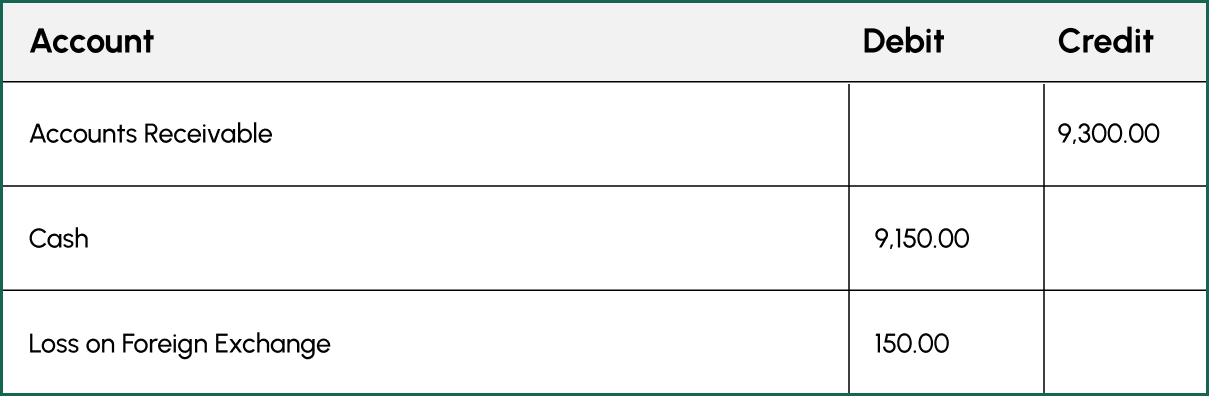

Your client has 30 days to settle the invoice, and on the 28th of March, they wire $10,000 to your bank account. However, since the invoice was issued, the Euro has depreciated against the USD, and the amount you receive is now €9,150.

You initially expected €9,300, but due to fluctuations in exchange rates, you have now received €9,150 which is €150 less than the originally recorded sales. At this point, your total actual sales are €9,150. To balance the books, the missing €150 is recorded as a "Loss on foreign exchange." This entry offsets the higher expected sales in your records.

We credit accounts receivable for €9,300, debit cash for €9,150 (the actual amount received), and debit "loss on foreign exchange" for €150.

Recording a gain

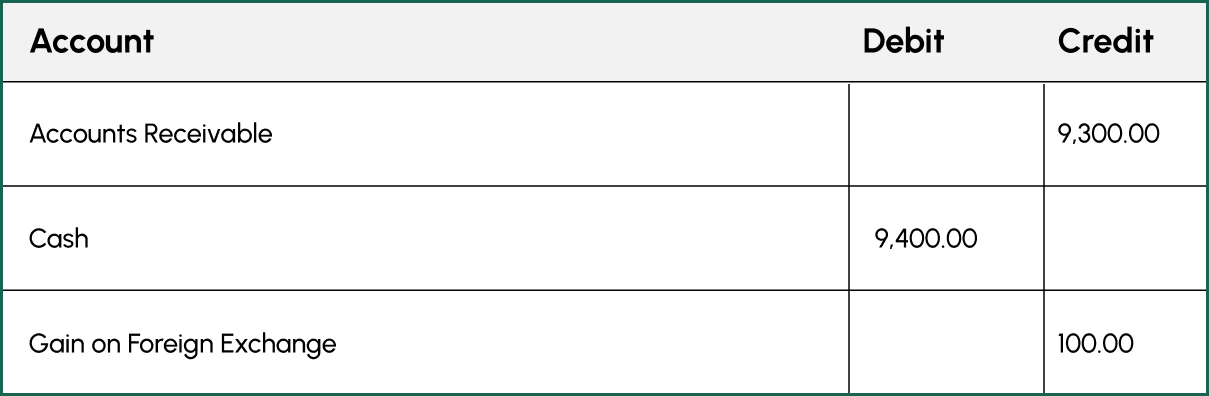

In the opposite scenario, you may receive a higher amount than expected. For example, instead of receiving €9,300 as initially recorded, you receive €9,400. In this case, you earn €100 more than the recorded sales value. To balance the books, the extra €100 is recorded as a "Gain on foreign exchange."

We credit accounts receivable for €9,300, debit cash for €9,400 (the actual amount received), and credit "gain on foreign exchange" for €100.

Gain/loss on foreign exchange, income statements, and taxes

In most parts of the world, any gain or loss on foreign exchange is considered part of your income statement. Depending on local regulations, it is typically reported in the "other income/expense" or "financial income/expense" section.

- In the case of a gain, it is added to your taxable income.

- In the case of a loss, it is deducted from your taxable income.

Why we record them separately

You may wonder why we don't just adjust the initial entry, and why a separate line in the journal is required. There are two main reasons:

First, it may be against the law to edit old journal entries. In many places, modifying your books is discouraged or prohibited, as tax auditors require an unaltered audit trail. One prime example is Germany's GoBD framework, which we explain in another article here.

Second, these gains or losses are not just accounting entries, they reflect the actual difference you experienced during the transaction, with a real impact on your cash flow. However, the value of the product or service you sold has not changed. Using the earlier example, you sold €9,300 worth of products/services, but due to exchange rate fluctuations, you received less or more cash.

Recording the difference as a gain or loss on foreign exchange is important, because it separates your sales performance from currency fluctuations.

If you incur a loss due to exchange rates, your product/service has not become less profitable or desirable. Conversely, if you incur a gain, your product/service has not suddenly become more profitable or desirable. Your business fundamentals remain unchanged, the difference in your cash flow is solely due to external factors beyond your control.

Where this data is important

Once properly recorded, you will have a clear overview of why your cash flow is lower or higher than expected. As mentioned earlier, this information is not very useful when evaluating the quality or desirability of your product/service. However, it provides valuable insight into your pricing and billing strategy.

If you are dealing with stable currencies, such as USD/EUR, gains or losses due to exchange rate fluctuations may not significantly affect your business. But if you are dealing with a less stable currency, the changes can be substantial.

For example, the Turkish Lira has been consistently losing value over the last decade. If you are dealing with the Turkish Lira and do not account for possible exchange rate changes, losses on foreign exchange could wipe out your entire profit margin. In such cases, you need to take measures to minimize risk and regularly monitor foreign exchange losses.

How ReChive manages the gain/loss on foreign exchange for you

When using the ReChive app by Vieolo, we automatically handle the calculation and recording of discrepancies caused by currency exchange.

If you issue or receive an invoice in another currency, all you need to do is select the invoice currency when saving the ReChive entry. Vieolo automatically converts the total invoice amount to your workspace currency and records the corresponding journal entries.

After the invoice is paid, you can record the payment on the entry page. When recording the payment, the exchange rate used by Vieolo is displayed, and you can edit it to match the actual exchange rate applied to the transaction.

If the final payment differs from the original invoice amount after conversion, the difference is automatically recorded as a gain or loss on foreign exchange. This entry is then reflected in your income statement.